(TAXING) THE BIRD IN THE HAND… AND THE TWO IN THE BUSH?

Read more

September 14, 2024 | 4 min read

Author: Andy Wood

I saw a post from a wee young scamp on social media yesterday.

He had, we are told, bought a house last month for $1,925,000 and today, using only his genius, had sold for $2,250,000.

A cool $325,000.

Of course, I have a one track mind, and immediately thought tax.

Lets say this was the UK. And rather than dollars, it was good old GBP. (Yes, because I’m lazy and can’t be bothered converting it)

I am assuming this was not his main residence as it would seem odd to flip it like this. So, it would be subject to the 3% surcharge on the basis it was a residential property and, on the day of acquisition, he owned more than one property at midnight.

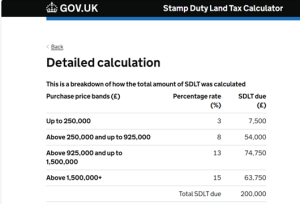

So, lets plug that into HMRC’s calculator (Yes – I am also too lazy to work this out.)

The result is a cool £200k of SDLT.

Let’s say it costs him £5k in legal costs as well.

So, m’lad is already in the hole for £205k.

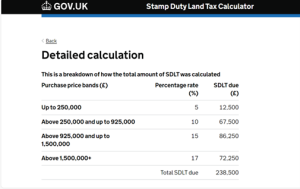

However, he is a US resident. So, lets assume that he has the temerity to purchase the property as a non-UK resident. Here, the UK government would once again be looking for another slice of flesh and each of the respective SDLT would be increased by another 2%.

The total SDLT would now be £238,500.

Blimey Charlie!

He would already bin in the (even bigger) hole for £243,500.

So, this leaves us with our US property investor finding that he is bragging on social media for a gain worth £82,000.

Still not too shabby for a month’s work?

Well, we’ve looked at the purchase above. Now let’s look at the selling end.

Let’s say he gets a good offer on legals this time (due to his repeat business) and he is charged £2k instead. We are talking VAT inclusive here as, you guessed it, I’m lazy.

So, that leaves us with a nice round £80k.

Fortunately, we will get deductions for the legal costs above and the stamp duty land tax. (Come on, the UK system isn’t that unfair(!))

In the not too dim and distant past, our Finfluencer would have been outside the scope of UK CGT. But thanks to George Osborne and the introduction of Non-Resident CGT he is well within it’s cross-hair.

So, the £80k is likely to become, well, not £80k?

Shall we say he still has some CGT annual exemption left (is this choose your own adventure?). Ok, go on then.

Bad news is, its now a shadow of its former self and worth a measly £3k.

So, his taxable gain is now £77k.

Let’s assume that he has no personal allowance / basic rate band (he has some UK income which he was disappointed he had to pay some tax on) so all taxed at Jeremy Hunt’s 24% rate ( a rate / distinction that will surely disappear in the October Budget?).

This means further tax of £18,480.

So, after tax and expenses, that profit of £325,000 would be £58,520.

Better than a poke in the eye with a selfie-stick, but…

…what if it wasn’t classed as an investment?

What if all of our Finfluencer’s video’s on flipping properties (assuming they were real) led HMRC to argue that it was a trade. So subject to the significantly higher rates of income tax and NICs?

He’s now taking home even less…

I need a rest.

The moral? Don’t let the tax tail wag the investment dog, but be careful—ignoring the tax tail completely could leave you investing in a bit of a dog.

Also, the UK SDLT system is an absolute dog’s dinner…

Disclaimer – Any miscalculations above are not my responsibility. They are my mathematics teacher’s.