(TAXING) THE BIRD IN THE HAND… AND THE TWO IN THE BUSH?

Read more

September 4, 2024 | 4 min read

Author: Andy Wood

Introduction

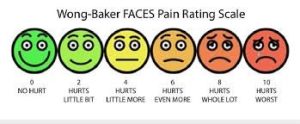

In the previous chapters we’ve looked at how measures in the Starmer / Reeves cavalcade of Budget pain might fit within the Wong-Baker scale.

Here it is again:

Tus far, we’ve covered 0-6 on the scale, or, if you prefer, No Hurt – Hurts Even More.

A painful journey.

As if that’s not enough, we now consider a Wealth tax, which perhaps has the potential to ‘Hurt a Whole Lot’…

Of course we do.

We tax transfers of wealth in lifetime and death through Inheritance Tax (“IHT”).

We tax the capital return from wealth through Capital Gains Tax (“CGT”).

We tax income returns from wealth through income tax.

Further, we also commonly tax property purchases through Stamp Duty Land Tax and also we have (less commonly) the Annual Tax on Enveloped Dwellings (“ATED”) where one broadly lives in a property that has been ‘enveloped’ in a Company.

However, they all require doing something with the wealth. We do not have a tax that is simply levied because you own lots of stuff.

A report written by the self-appointed Wealth Tax Commission (“WTC”) states that the current suite of wealth taxes is “dysfunctional”.

I think describing the UK tax system as dysfunctional is amazingly restrained by the litmus of current public discourse. So kudos to them.

The WTC also set out a paper on a UK wealth tax. It was largely dismissed by the Tories.

But, remember, we’re now talking about life in a world of pain.

Indeed, the newly formed Pain Commission could well like such a proposal. So, let’s see what the WTC said.

In their report, the WTC preferred a one-off wealth tax rather than an annual tax.

Although at pains to point out they weren’t making any recommendations, the WTC did set out some illustrations:

Based on a rate of 5% (spread over 5 years) the first of these would reportedly raise a stonking £260bn.

Plenty enough to cover the £20b sized blackhole… several times over.

In respect of the second of these, then the tax take would be £80bn.

A lower amount, but would still leave some change to cover any other fiscal black holes uncovered further down the track.

These are huge sums of money.

This is illustrated by what alternative changes might be necessary to raise £250m over 5 years:

Gulp!

The WTC’s proposal was that it would apply based on a person’s residence.

Importantly, it was proposed that there should be a residence tail such that, if one was resident, say, for 4 out of the previous 7 tax years, then one would be subject to the tax even if one had left by the time it was enacted.

Of course, this would limit the ability to take pre-emptive action.

The proposal was that ALL wealth above the thresholds would be taxed.

The report is very clear that ‘exceptions’ and ‘exemptions’ should be resisted to keep the tax base as wide as possible.

This is a bold (and potentially politically incendiary) proposal. Their proposal is that wealth in pensions, main residences and businesses would be up for grabs.

Yikes!

It is stated in the report that 40% of the UK’s wealth is tied up in pension schemes and, as such, it would adversely affect the success of a wealth tax where this source was excluded.

However, this could easily bring in healthy public sector final salary / defined benefit schemes once they have been capitalised.

However, Reeves has previously, explicitly, ruled out a wealth tax. As such, it might be the potential political pain that meant this didn’t happen.

But that leads us to the final part of this agonising series…

…trust me, I’m a doctor.

This is going to ‘hurt the most’