(TAXING) THE BIRD IN THE HAND… AND THE TWO IN THE BUSH?

Read more

August 27, 2024 | 4 min read

Author: Andy Wood

Way back last month, we were told by Oxford Economics that the new chancellor would “kitchen sink it” in her Budget.

We now know the budget will be on 30 October – the afternoon before All Hallows’ Eve.

We’ve already seen the portent of doom upgraded to a “tax bombshell”.

Now it will be one of pain.

The Wong-Baker Faces Pain Rating Scale uses some emoji style faces for patients to explain their pain.

As such, the obvious thing to do seems to be to set out some potential tax raising plans that could be implemented and to pace them on the Wong-Baker taxpayer pain scale.

Obviously….

Over the next few weeks, we will cover:

This is gonna hurt…

Of course, like tax increases, increased levels of pain might be acceptable if they are experienced by others.

We are told that the most pain will fall on those with the broadest shoulders. So, this might suggest that any changes might effect the wealthiest more than the rest (tell that to those who have lost thei winter fuel allowances).

As such, if you don’t need to turn sideways to walk through a doorway, you might feel you will escape Reeves’ budget pain.

Having ruled out increases in income tax, National Insurance and VAT, CGT stands out like the sorest of sore thumbs.

The main rate of CGT tops out at 20%. This is well below the top rate of income tax or 45% (plus NICs if earned income).

The rate is slightly higher for sales of residential property – which is now 24%… having been 28% until Jeremy Hunt’s budget earlier this year.

So, as we’re talking about sore thumbs, might Reeves apply a thumb screw to those who are thinking of selling a second property or a business?

Could Reeves look at equalising the two?

If she did, this would be a measure straight out of the Green Party’s recent manifesto.

One technical issue with equalising the two is that, at present, gains that are purely as a result of inflation are taxed.

So, there’d really need to be a re-introduction of indexation relief. Which is no biggie

However, as it happened, I am not sure that she will go quite this far.

But might we might seen the top rate going up to, say, 25% or 30%?

However, a key question is whether this will actually raise any revenue at all. Perhaps surprisingly, the Government’s statisticians say no:

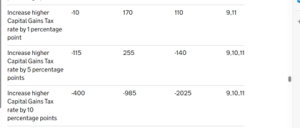

It should be noted that the left column is the additional revenue raised in 2025/26 and then 2026/27 and then 2027/28. For the avoidance of doubt, this is in millions.

So, if these figures are to be believed, an increase in the top rate to 30% would actually reduce the tax take by just under £3.5b over three years.

A smaller increase of 1% would raise £250m over the same period.

These figures purportedly take into account the behavioural changes of taxpayers affected by the measures. The bigger the rise, the bigger the potential change in behaviour.

The position is perhaps more intuitive when it comes to scrapping or further curtailing the BADR CGT relief. I look at this in the next part of this series.

Of course, rumours of rate rises and the scrapping of reliefs in themselves have the effect of generating revenues by accelerating decisions to, say, sell businesses trying to get ahead of the changes.

Indeed, I suspect there are many conversations happening in accountancy offices up and down the land on this.

“Sell now, before rates go up.”

So, even the talk of CGT rises raises revenue for accountants and tax advisers.

Kerching.

In this part, we’ve introduced the portent of pain we’ve heard around the budget.

We’ve looked at the fact that many measures might mean no pain (for some) and some measures that will perhaps cause a little pain.

But what about increased levels of fiscal ouch-iness?

We will turn the rack a little in the next part.